Green Bonus 2020

Guide to facilities for interventions with green areas

What is the GREEN BONUS?

The facility was introduced with the 2018 budget law (article 1, paragraph 12 of Law no.205 of 2017) and then extended in 2019 (article 1 of Law 145 of 2018) and 2020 (article 10 of Law Decree no. 162 of 2019) and allows the Italian state to have concessions in terms of landscaping interventions.

It is a 36% Irpef deduction on the expenses incurred in 2020 for the following interventions:

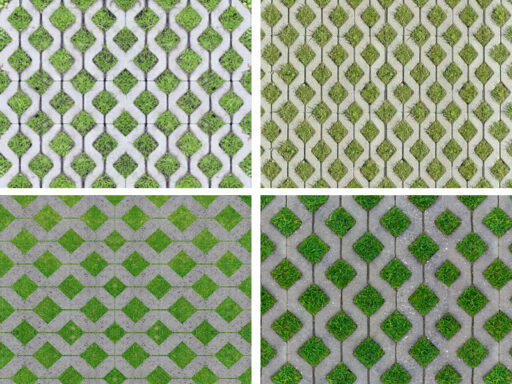

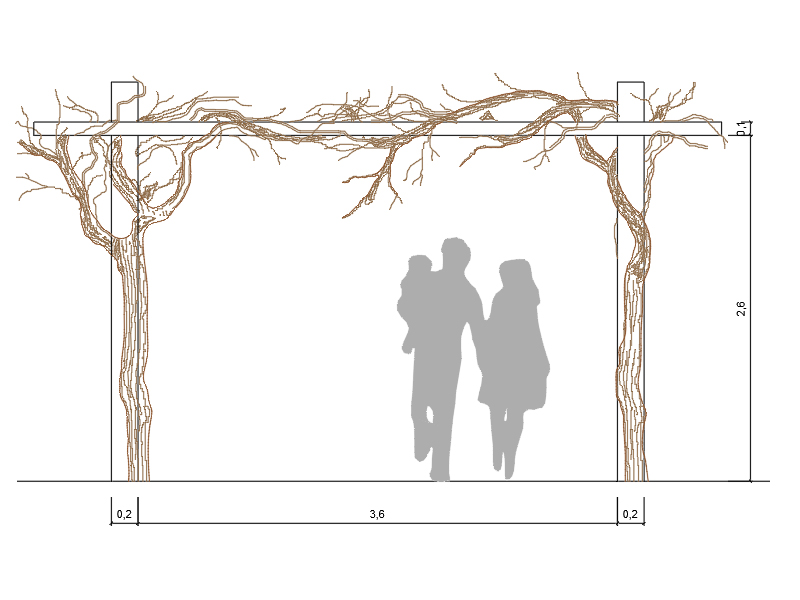

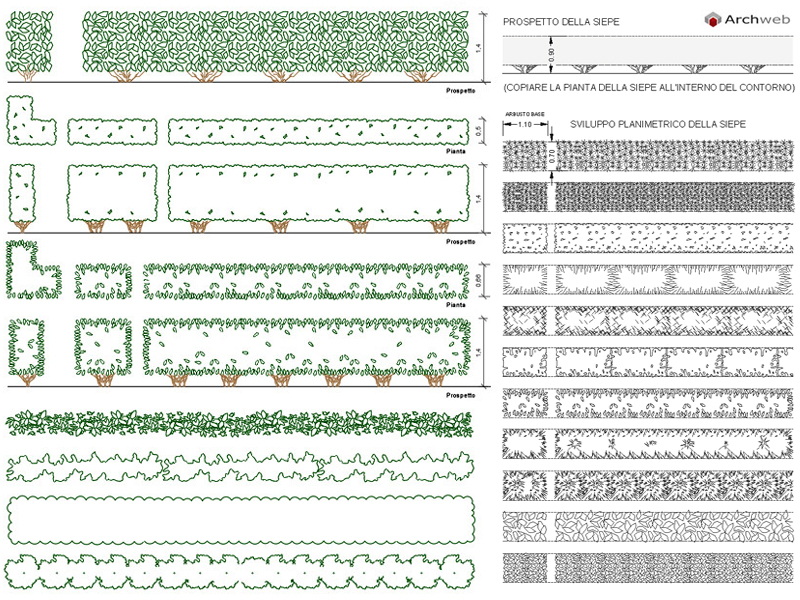

- green arrangement of private uncovered areas of existing buildings;

- real estate units, appliances or fences;

- irrigation system and well construction;

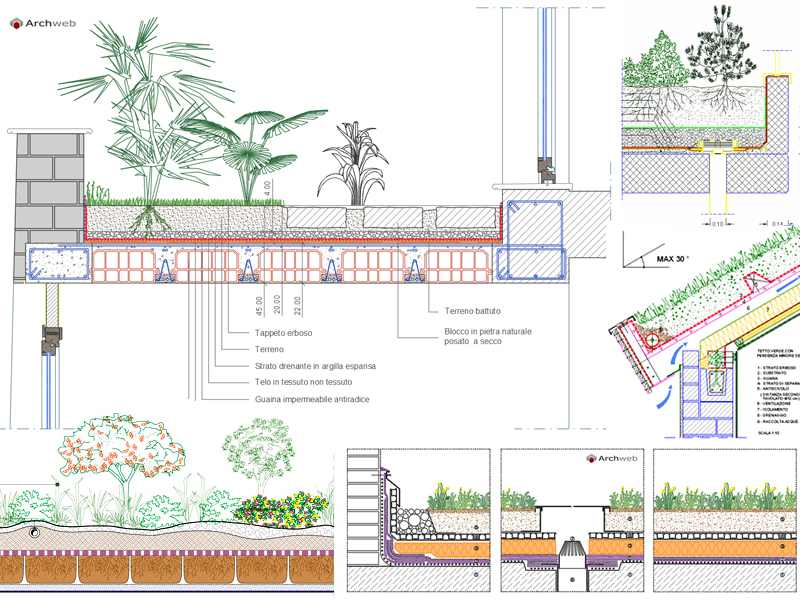

- construction of green roofs;

- hanging gardens;

- design expenses;

- maintenance related to the execution of the interventions.

The Revenue Agency also specifies that the deduction must be divided into ten annual installments of the same amount and must be calculated on a maximum amount of 5,000 euros per residential unit.

The maximum deduction is 1,800 euros per property (36% of 5,000).

In addition, the green bonus also applies to condominium buildings and is also due to expenses incurred for interventions carried out on the external common parts; up to a maximum total amount of 5,000 euros per residential property unit. In this case, the individual condominium has the right to the deduction within the limit of the quota attributable to him, provided that the same has actually been paid to the condominium within the terms of presentation of the tax return.

Works excluded

The deduction is not, however, due to expenses incurred for:

- periodic ordinary maintenance of pre-existing gardens not connected to an innovative or modifying intervention in the terms indicated above;

- jobs in economics.

Do I need to apply for an authorization?

No, it is sufficient to follow the categories of intervention indicated above and ensure that the payment is electronically traceable.

Payment method

I can pay by bank transfer or credit card taking care to keep the payment receipts and any invoice.

Do I have to enter a reason for the transfer?

No, it is not mandatory, it is mentioned in the guidelines of the Revenue Agency. If you want to specify you can use:

“Bank transfer for” Green Bonus “deductions pursuant to paragraphs 12 to 15 of Law no. 205/2017. Payment of invoice no. __________ dated 00/00/0000 in favor of _________________”

Reference legislation

Article 1, paragraph 12 of law no. 205 of 2017

Article 1 paragraph 68 of Law 145 of 2018 – Extension 2019

Article 10 of Law Decree no. 162 of 2019 – Extension 2020

Practice

Circular no. 13 of 19 May 2019 – Guide to the tax return of individuals relating to the 2018 tax year: expenses that give the right to deductions from income, tax deductions, tax credits and other relevant elements for completing the return and for affixing of the compliance visa

Circular no. 8 of 10 April 2019 – Comment on tax news. Law 30 December 2018, n. 145 – “State budget for the financial year 2019 and multi-year budget for the three-year period 2019-2021” (Budget law 2019). First clarifications and answers to questions posed during videoconference events organized by the specialized press

NB: the articles of laws, decrees, legislative decrees, etc. they may have been modified by subsequent regulatory interventions. Consult the text currently in force using the search engine for economic and financial documentation

Source: www.agenziaentrate.gov.it