Superbonus: ecobonus and superbonus 110

110 keys for a green restart?

Superbonus 110. What is it, what are the requirements to use it and who can benefit from it?

The tax break called Superbonus 110 percent is an incentive measure that was introduced in our country following the publication of the Legislative Decree. “Relaunch” 19 May 2020, n. 34 and which in the intentions of the legislator aims to make Italian real estate more efficient and safe.

Concretely, the Superbonus measure is structured into two different types of intervention:

- the actual Super Ecobonus, which facilitates energy efficiency work;

- the Super Sismabonus which aims to encourage the anti-seismic adaptation of properties located in Italy.

From a fiscal point of view, however, the Superbonus is characterized by being a “simple” tax deduction of 110% to be applied on expenses incurred from 1 July 2020 to 30 June 2022 (for autonomous public housing institutes the time limit for deducting the expenses extends until 31 December 2022, which can be further extended until 30 June 2023 if at least 60% of the works have been completed by 31 December 2022; while for condominiums the time limit is extended until 31 December 2022 if at least 60% of the works as of 30 June 2022) to be divided among those entitled in five annual installments and, for the part of the expenditure incurred in 2022, in four annual installments of the same amount.

Superbonus 110 and the importance of driving interventions

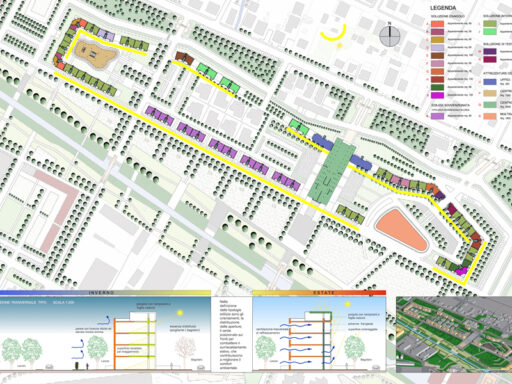

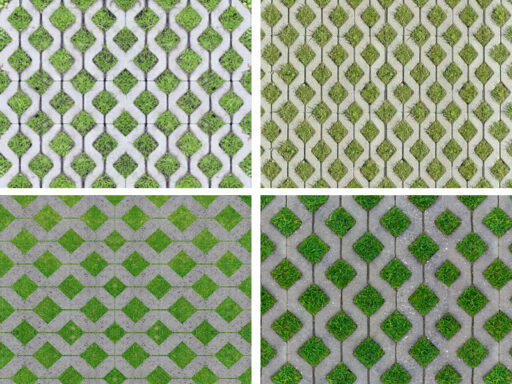

The superbonus is an important fiscal intervention which, in order to be implemented, requires at least one (so-called) driving intervention. The driving interventions, reading the official documents published on the Government website, consist of the thermal insulation of the building envelope, whether multi-family or single-family, the replacement of heating systems with centralized systems, the replacement of heating systems on single-family buildings or on real estate units located within multi-family buildings that are functionally independent and have one or more independent accesses from the outside.

How to link the driven interventions to the leading interventions?

Once the leading interventions have been carried out, it will be possible (if the beneficiary intends to do so) to implement a whole series of so-called driven interventions. The supported interventions are the replacement of fixtures, solar shading, the installation of photovoltaic systems, storage systems, charging stations for electric vehicles, home automation systems, the elimination of architectural barriers for people with disabilities. handicap in serious situations and for people over the age of 65 and much more.

The set of these interventions (driving and driven) must lead to a minimum improvement of at least two energy classes of the building or real estate unit located within multi-family buildings which is functionally independent and has one or more independent accesses from the external.

What are the requirements for Superbonus 110?

Properties subject to Superbonus. The Superbonus tax deduction can be applied to work carried out by condominiums, natural persons outside of business activity, autonomous social housing institutes (IACP), undivided ownership housing cooperatives, non-profit organizations of social utility, voluntary organizations , social promotion associations, amateur sports associations and clubs, natural persons residing in buildings consisting of two to four distinctly registered real estate units owned by a single owner or co-owned by several natural persons.

Subjects protagonists of the Superbonus

All natural persons who live in condominiums, in buildings consisting of two to four distinctly stacked real estate units owned by a single owner or in co-ownership, in single-family buildings or in real estate units located within multi-family buildings can benefit from the Superbonus provided that these are functionally independent and have one or more independent accesses from the outside.

When a property can be considered “functionally independent”

A property can be considered as “functionally independent” when at least three of the following installations or works of exclusive ownership are present: water supply systems, gas systems, electricity systems, winter air conditioning system .

The Revenue Agency has updated the Superbonus 110% guide with all the regulatory changes relating to the benefit until September 2021.

Download the guide (pdf)